A Winnipeg man is sending a warning to Canadians after he found himself caught in the middle of the Canada-U.S. trade war – a war that could cost him more than $46,000.

Pat Fletcher has spent a lifetime restoring classic cars in Winnipeg. But the 77-year-old car enthusiast has had a lifelong dream to own one car in particular – a 1968 Dodge Charger RT.

“When I was 15, I had a Charger,” he told CTV News. “I always wanted to get this Charger RT… It’s the best one out there, and they’re hard to find.”

Which is why he was so excited when he found one down in Texas, buying it for US$98,000 on March 10. But his dream quickly turned into a nightmare when he tried bringing the car back home.

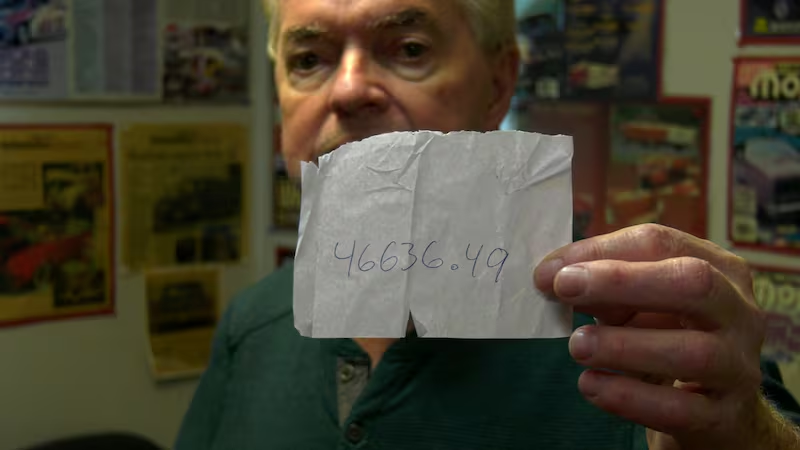

At the Canadian border, agents handed him a massive bill for $46,636.49.

“I just about fell out of the chair. I was just – I was in shock,” Fletcher told CTV News, saying he was immediately sick.

Fletcher said the agents told him his car would be subject to a 25 per cent tariff, along with other taxes.

With no way to pay the huge amount, Fletcher was handed a goods refusal letter stating his car does not meet the requirements to be imported into Canada.

He was then turned away.

“That was it. I couldn’t do anything about it. I had to leave the car there and come back home. Just hope for the best,” he said.

Fletcher said he checked the list of Canadian tariffs before purchasing the car, doing what he could to make sure something like this wouldn’t happen.

So how did it happen?

If you look on Canada’s list of U.S. items subject to reciprocal tariffs, vintage cars are nowhere to be seen.

CTV News Winnipeg reached out to the Canadian Border Services Agency (CBSA) for clarification. It took more than two days for a response, as a spokesperson said there were several factors to look at.

In the end, the agency confirmed there is a 25 per cent tariff in place.

But it’s hard to find.

Buried on a customs notice is a list of codes subject to the surtax. It is only when you go to Canada’s Customs Tariff Act that you find out one of those codes includes vehicles manufactured more than 25 years ago.

“Based on the information available, a 1968 Dodge Charger may qualify for (the tariff item) which is subject to the surtax,” the CBSA spokesperson told CTV News.

Fletcher has tried calling the company that sold him the car, but was told they won’t take it back.

For now, his dream car sits in a rented parking space in North Dakota. Meanwhile, Fletcher sits in his empty garage, hoping the tariffs may be called off – even temporarily – and he can finally bring his dream car home.

Until then, he said his nightmare is a warning to Canadians.

“I want people to be careful and know what can happen to them,” he said.

Canadians looking to import items from the U.S. can request an advanced ruling on tariff classification online to find out if tariffs apply to them.

If anyone thinks they have been taxed improperly, they can request an adjustment from CBSA.